The €2.7bn ($3.12bn) purchase of Bally’s technology unit closed today. July 2025 marked the initial announcement of this merger.

Main Details

- Intralot transferred €1.53bn ($1.77bn) cash and €1.14bn in new shares to Bally’s Corp.

- Bally’s Corporation now controls 58% of Intralot’s equity.

- October 8 saw Intralot complete a €429m share offering.

July 2025 brought the agreement for Intralot to purchase [Bally’s International Interactive] business. The transaction closed this week. Cash and Intralot shares worth €2.7bn paid for Bally’s technology division. Bally’s Corp gained majority control of Intralot through the share transfer. The company will influence strategic planning more directly.

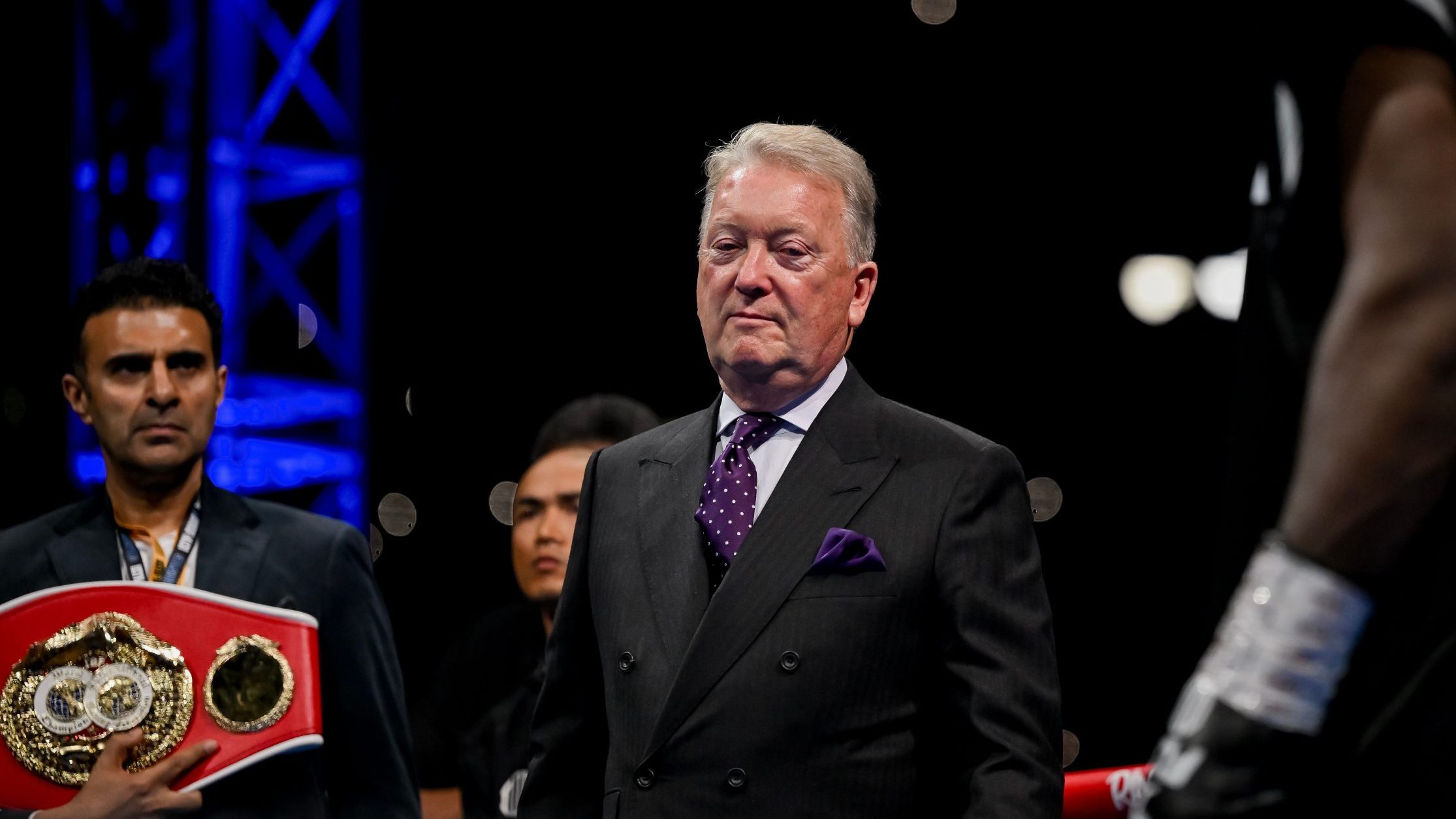

Robeson Reeves leads Bally’s Corp and will guide the combined Bally’s Intralot entity. Reeves commented after closing: “Our shareholders see our interactive division’s value within a larger global operator. Intralot brings lottery knowledge and geographic presence. Bally’s International Interactive adds digital strength. Together, they build a platform for long-term growth.”

Allwyn bought PrizePicks recently. A European lottery company joined with an American gambling firm. Bally’s will use $1.0bn from the cash payment to pay down secured debt. The company plans to spend $200m developing its Chicago casino project.

Companies

Companies