South Africa’s National Treasury has proposed a new national tax on online gambling to help reduce the social harm linked to heavy gambling. In a paper released on 25 November, the Treasury suggested a 20 percent tax on gross gambling revenue from online betting and interactive games. The tax could raise about R10 billion, but the government says its main goal is to curb problem gambling and protect vulnerable people.

The paper noted that casual gambling does not harm society, but problem gambling does. Because of this, the government believes stronger rules and higher taxes are needed to reduce risky behaviour.

Online Gambling Growth Raises Regulatory Concerns

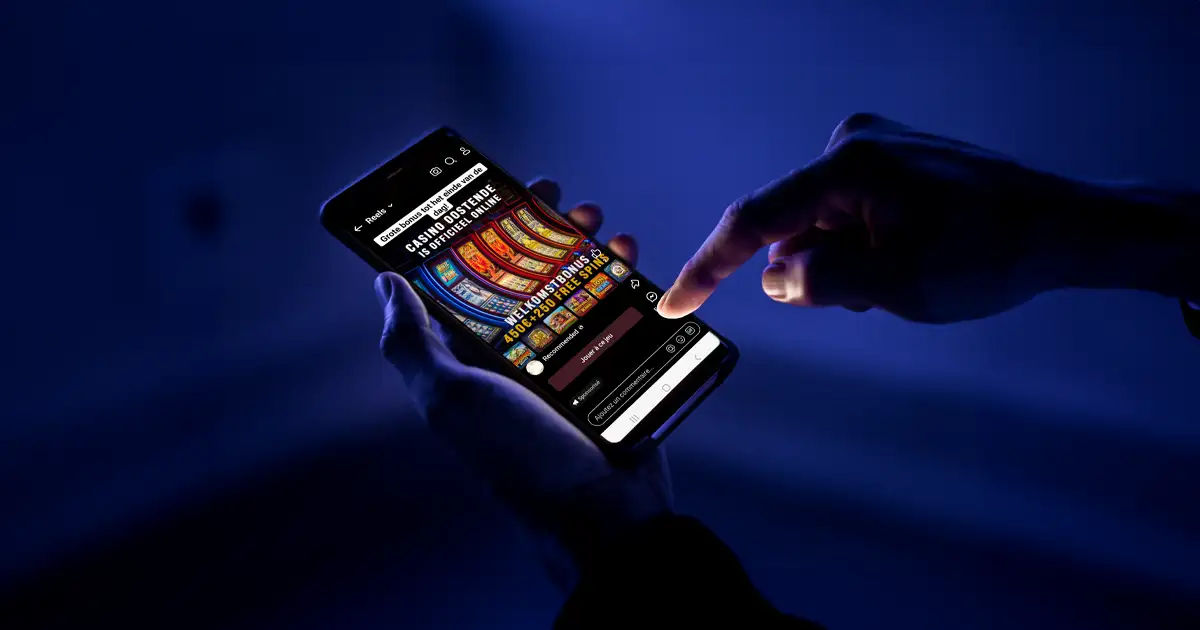

The Treasury noted that South Africa’s gambling industry has shifted quickly toward online platforms. Better technology and wider internet access after the Covid 19 pandemic helped drive this change. Traditional gambling used to lead the market, but online betting now takes a much bigger share.

Figures from the National Gambling Board show that total gambling turnover for 2024 and 2025 reached about R1.50 trillion, up 31.3 percent from the previous year. Sports and horse racing bets made up 75 percent of this amount, while casinos contributed just under 20 percent.

The Treasury also said the current provincial licensing system cannot fully control online gambling. Each of the nine provinces has its own regulator, but online betting crosses borders, making it harder to supervise and enforce rules properly.

National Tax Aims to Close Gaps in Regulation

The proposed national tax is intended to simplify administration and prevent provinces from competing to offer lower taxes to attract operators. The 20 percent levy would be added on top of existing provincial taxes, bringing the overall rate to between 26 percent and 29 percent.

According to the Treasury, many countries with large online gambling industries already apply similar or even higher tax rates. Local online betting companies would also need to register with the South African Revenue Service and provide the same information they currently send to provincial gambling boards.

The levy would also apply to operators offering online casino games, even though the activity remains illegal at the national level. Some provinces, however, have found ways to license fixed odds casino style games under existing sports betting rules.

Provinces and Policy Developments

The Western Cape and Mpumalanga have been leading the shift by allowing bets on virtual games, live dealer casino games and other fixed odds products. As a result, most online operators today hold licences from one of these two provinces.

Earlier this year, the Democratic Alliance introduced an online gambling bill in parliament. However, the proposal has made little progress. The Treasury has now invited public comments on the draft tax plan, with a deadline set for 30 January.

Companies

Companies